This Blog will explain the Schedule 1 Adjustments to Income categories that are available to Taxpayers for the 2018 Tax Year. Service Tax AmendmentNo 3 Regulations 2018.

Correctional Officer Resume With No Experience New 75 Luxury Image Resume Examples For A Retail Manager

The engraving of articles with the name of the recipient his sports record or other circumstances under which the article was donated or awarded.

. First Schedule to the Service Tax Regulations 2018 STR states Where a company provides any taxable service to a person outside the group of companies the same taxable service provided to any company outside or within the group of companies shall be a taxable service. Service tax SST Service tax SST exemption from 1st March to 31st August 2020 is extended to 30th June 2021. The effective date of the Service Tax Act 2018 is 1 September 2018.

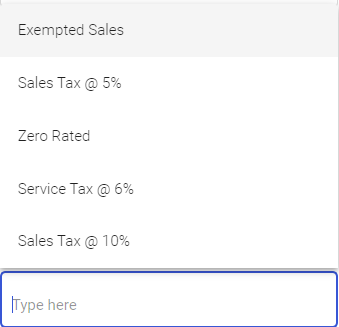

- The actual value of the imported taxable services. Taxable services are any services listed in the First Schedule of the Service Tax Regulations 2018 which are divided into Groups A to I. In 2018 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1 and 2.

OW FOONG PHENG Permanent Secretary Ministry of Finance Singapore. C The imported digital service must be for the furtherance of his. 2018 5 iii an activity of a person other than an individual that.

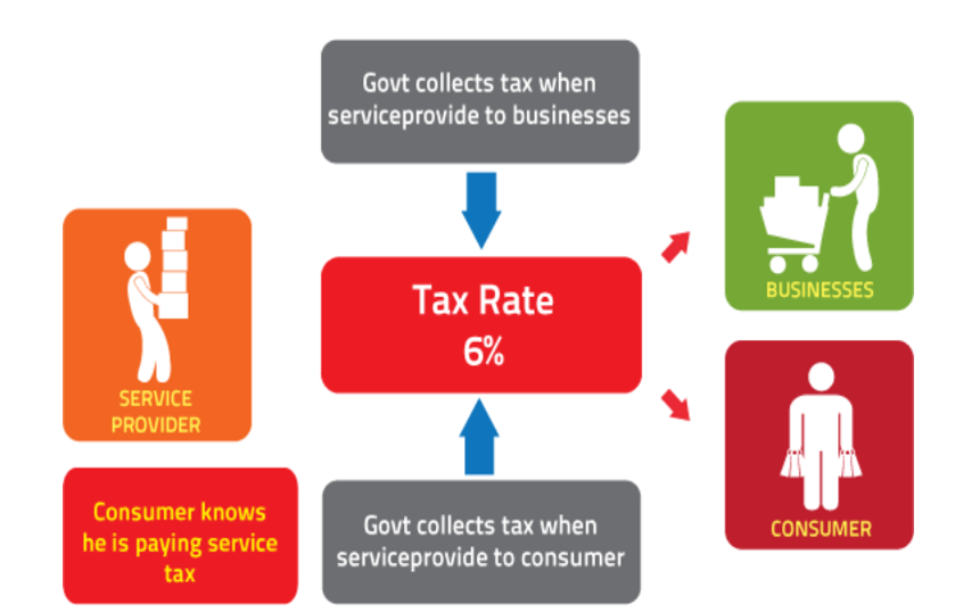

Section 7 of the Act provides that service tax shall be charged and levied on any taxable services provided in Malaysia by a registered person1 in carrying on his business. The actual premium or contribution paid for insurance takaful. Federal Inland Revenue Service Establishment Act.

SCHEDULE A - SALES TAX EXEMPTION FROM REGISTRATION ORDER 2018 1. Standard deduction amount in-creased. The Form SST-02A needs to be submitted and the payment needs to be made not later than the last day of the month following the end of the month in which the payment on the service has been made by him or invoices is received by him.

Income Tax Authorised. On 17th June 2020 Royal Malaysian Customs Department RMCD has published the latest update on Service Tax Policy 92020 Service Tax Treatment on Group A. A person who provides taxable services exceeding a specified threshold is.

Citation commencement and application. Deep Offshore and Inland Basin Production Sharing Contracts Act. Or Acquired from connected person - The value of the imported taxable services which would have been acquired in the ordinary course.

Single or Married filing sepa-rately12000. Companies Income Tax Act. Married filing jointly or Qualify-.

1 These Rules are the Income Tax Transfer Pricing Documentation Rules 2018 and come into operation on 23 February 2018. The First Schedule to the Service Tax Regulations 2018. Change in tax rates.

The penalty is 5 of the unpaid tax plus 05 for each month or part of the month not to exceed 40 months the tax remains unpaid. Service Tax is a consumption tax governed by the Service Tax Act 2018 and its subsidiary legislation. Ad Browse Discover Thousands of Book Titles for Less.

Any corporation that fails to pay the total tax shown on Form 100 by the original due date is assessed a penalty. The developing and printing of photographs and the production of film slides. Ad Prepare and file 2018 prior year taxes for Indiana state 1799 and federal Free.

A complete list of taxable persons and taxable services can be found in the First Schedule to the Service Tax Regulations 2018. Now for 2018 individuals get a 1118 million lifetime exemption and married couples get to exclude 224 million. Effective from 1 January 2019 paragraph 3A of the First Schedule of the Service Tax Regulations 2018 provides for group relief on imported professional services services under Group G of the First Schedule excluding employment and security services acquired by a local company from any company within the same group of companies outside Malaysia.

Group A Accommodation Group B Food and beverage. For 2018 most tax rates have been reduced. Associated Gas Re-Injection Act.

Tertiary Education Trust Fund Act. The authoritative instrument for the distribution of all forms of official IRS tax guidance is the Internal Revenue Bulletin IRB a weekly collection of these and other items of general interest to the tax professional community. Capital Gains Tax Act.

Service tax is imposed on prescribed services called taxable services. Exempt supplies means supplies specified in the First Schedule which are not subject to tax. Group relief Service tax is not applicable to the following transactions performed among companies within a qualifying group of companies ie.

Value Added Tax Rev. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. The Malaysian recipient company must be registered for service tax under the Service Tax Act 2018.

The new tax law doubles these exemptions. Premium Federal Tax Software. The First Schedule to the Goods and Services Tax Act is amended Made on 18 June 2018.

This Order is the Goods and Services Tax Act Amendment of First Schedule Order 2018 and comes into operation on 25 June 2018. Amendment of the First Schedule to the Service Tax Regulations 2018. Amendment of First Schedule 2.

In accordance with Section 26A of Service Tax Act 2018 the non SST registrant needs to pledge tax on imported taxable services in Form SST-02A. 2 These Rules have effect for the basis period for the year of assessment 2019 and every subsequent year of assessment. 1996-1 to present Individual IRB articles.

Service tax is not imposed on imported and exported services. First Schedule to the Services Tax Regulation 2018 except the taxable person specified in item 11 12. Accommodation under First Schedule Service Tax Regulations 2018.

Rate of tax The service tax rate is fixed at 6. Certain business expenses of reservist performing artists and fee-based government officials. The taxable service specified in column 2 Group G in the First Schedule to the Services Tax Regulation 2018 except the taxable services specified in paragraph j and k.

B The Malaysian recipient company provides the same digital service as the imported digital service. Prescribed in the regulations. The following are the existing tax legislation in Nigeria.

Tax registration certificate means a tax. Digital service tax that is charged upon foreign digital service providers that came into effect on the 1st of January 2020 falls under Group I. For 2018 the standard deduction amount has been in-creased for all filers.

Subject to certain qualifying criteria. The 2018 tax rates are 10 12 22 24 32 35 and 37. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 500000 and higher for single filers and 600000 and higher for married couples filing jointly.

As you can probably imagine this won. The incorporation of goods into buildings. Paragraph 8 of the First Schedule to the STR is added to include.

Acquired from non- connected person. Complete IRB publication in a printer friendly PDF format. Value of imported taxable services.

All Extras are Included.

Irs Issues Proposed Regulations On Section 199a Deduction For Solos Pass Through Businesses Payday Loans Online Payday Loans Fast Cash Loans

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Meaning Of Sgst Igst Cgst With Input Tax Credit Adjustment Sag Infotech

Cag Empanelment To Start From 1st January 2017 Http Taxguru In Chartered Accountant Cag Empanelment Corporate Law Goods And Service Tax Goods And Services

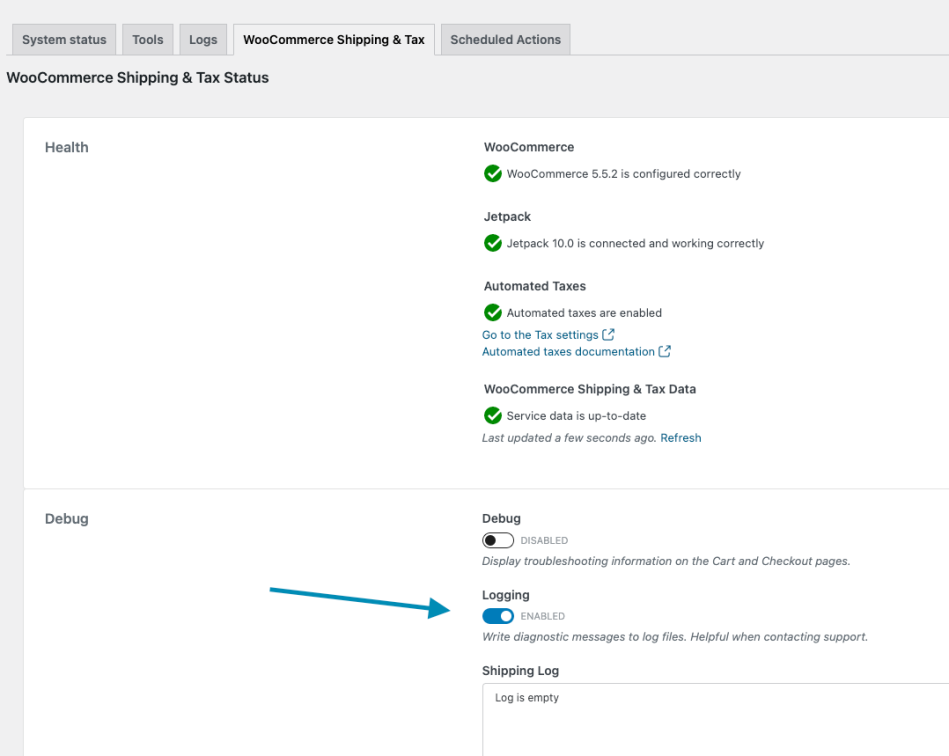

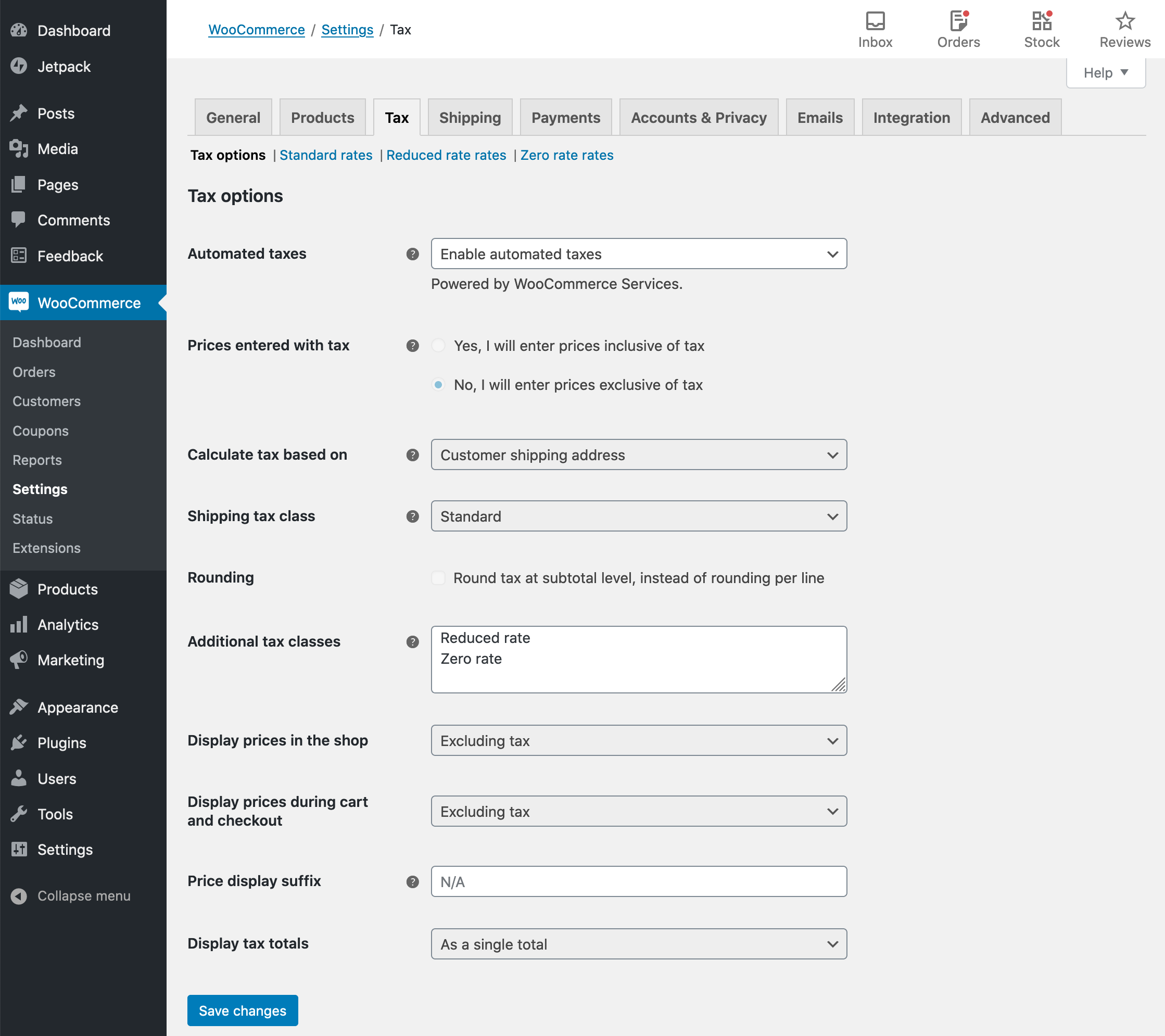

Woocommerce Tax Guide Woocommerce

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Woocommerce Tax Guide Woocommerce

Sales Service Tax Sst In Malaysia Acclime Malaysia

Correctional Officer Resume With No Experience New 75 Luxury Image Resume Examples For A Retail Manager

Calendar Template I Can Type In Printable Blank Calendar Template

Malaysia Sst Sales And Service Tax A Complete Guide

Fillable Form 1040 2017 Edit Sign Download In Pdf Pdfrun

Massage Therapist Resume Sample For Download

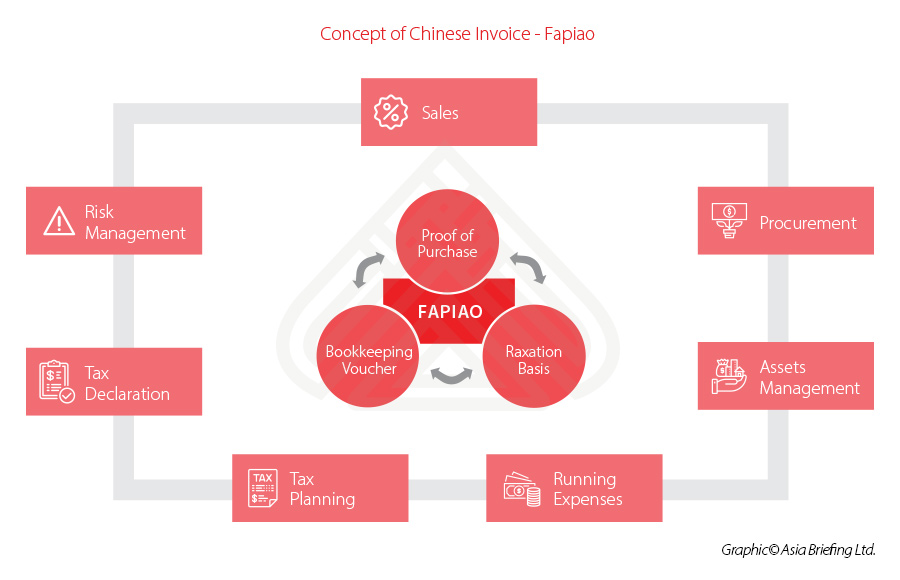

China S Fapiao Invoice System Explained China Briefing News